26+ Maximum borrowing capacity

Sample 1 MAXIMUM BORROWING CAPACITY Minimum Amount of Each Borrowing. It is inversely proportional to your other loan commitments and your age.

Capital Structure Complete Guide On Capital Structure With Examples

Typically if you dont have a deposit of 20 of the propertys bank valuation you may need to pay lenders mortgage insurance LMI.

. Bureau of Local Government Finance BLGF Certification indicating the Maximum Borrowing Capacity and Debt Service Cover9. Without any exceptions or approvals ABCs total borrowing capacity for Advances is 75 million 30 of total assets so long as it has sufficient qualifying collateral and is able and willing to purchase additional stock. Non-basics like vacations are excluded from the calculation.

Fast Easy Approval. Our Maximum Borrowing Capacity Calculator is mirrored to Mortgage Insurers parameters making it one of the most accurate estimators in the market today. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow.

For a conventional loan your DTI ration cannot exceed 36. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities. Factors that Affect a Borrowers Capacity.

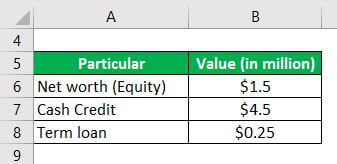

Each lender has various criteria that affect deal servicing and Salestrekker simulates all of them in one calculator. With respect to the definition of Borrowing Capacity in Section 11 of the Loan Agreement and Item 1 A of the Schedule thereto the Maximum Borrowing Capacity shall be increased from 7000000 to 8000000. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance.

One of the key elements is the expected loan interest rate. Click Now Apply Online. It is one of the 5 Cs of Credit analysis together with collateral covenant character and conditions.

Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. Your total minimum monthly debt is divided by your gross monthly. A borrowers capacity is the borrowers ability to make its debt payments on time and in full amount.

The figure may become part of a lenders calculation when assessing your borrowing capacity. With respect to the definition of Borrowing Capacity in Section 11 of the Loan Agreement and Item 1 A of the Schedule thereto the Maximum Borrowing Capacity shall be increased from 7000000 to 8000000. It uses a median expenditure on basic expenses eg.

Maximum borrowing is designed to closely match lenders actual borrowing capacity. If interest rates rise or unexpected expenses pop up and youre borrowing at your maximum capacity you may not be able to meet your repayments. Get Low-Interest Personal Loans Up to 50000.

The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance. Consider borrowing under what is deemed as your maximum threshold to make. Think of it as a maximum.

Estimate how much you can borrow for your home loan using our borrowing power calculator. This calculator provides useful guidance but it should be seen as giving a rule-of-thumb result only. A Any credit union which makes application for insurance of its accounts pursuant to title II of the Act or any insured credit union must not borrow from any source an aggregate amount in excess of 50 per centum of its paid-in and unimpaired capital and surplus shares and undivided earnings plus net income or minus net loss.

Our target is less than - 5 variance from lender calculators for all lenders. Yes the 6 times income multiple still holds water as a great way for a client to understand the potential for their borrowing capacity. Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI.

When you borrow like this the bank will finance up to 70 of the amount of your project the remaining 30 must then come from personal contributions or money from relatives namely the. View your borrowing capacity and estimated home loan repayments. Food childrens clothing combined with 25 of spending on discretionary expenses eg.

Debts may include minimum monthly credit card payments car payments student loans alimonychild support etc. This assist clients with the concept that earning a 100000 income will not be able to borrow 1000000 they are more likely to be able to borrow between 550000 to 650000 depending on their exact. Eating out childcare alcohol.

The Bank of Spain advises that the maximum amount that a family borrows should not exceed 35. The Best Offers from BBB A Accredited Companies. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration.

Fast Easy Form. Ad Fill in One Simple Form Get The Best Personal Loan Offers for You. Read more about what lenders look at in the.

In addition in terms of. This allows the remaining 60 65 or 70 of income to be used for essential expenses and for savings. Switch Finance - Maximum Borrowing Capacity.

You dont have to loan the full amount you are pre approved for.

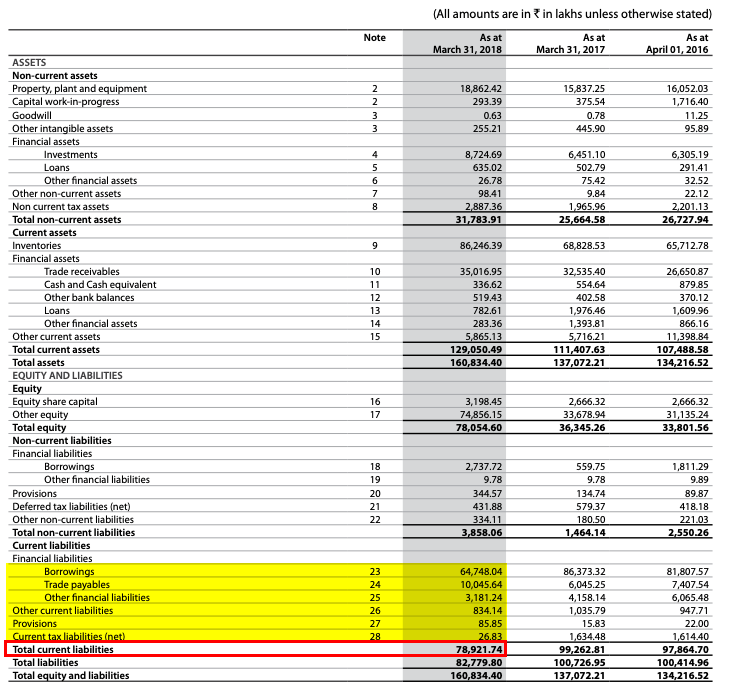

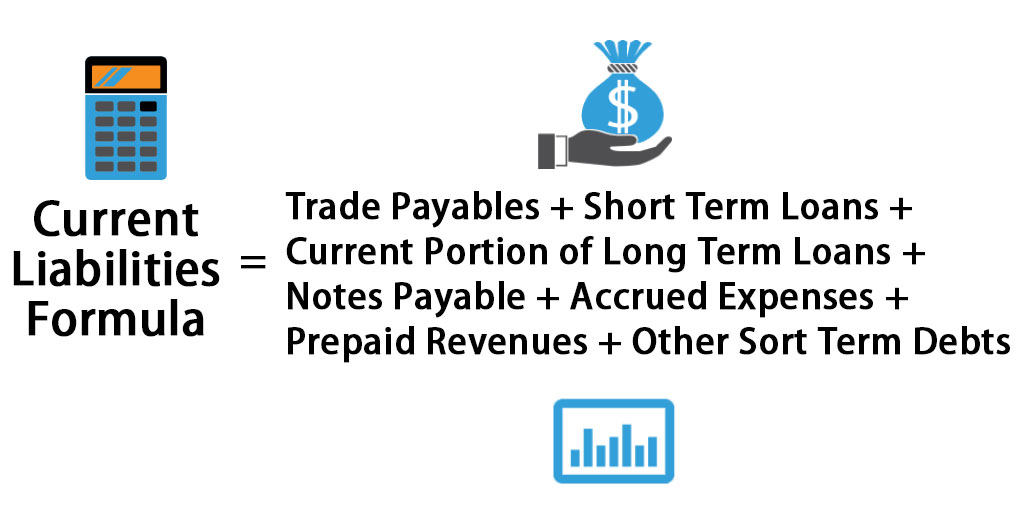

Current Liabilities Formula How To Calculate Current Liabilities

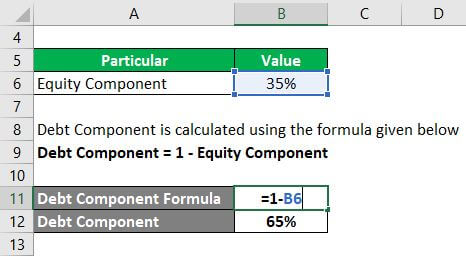

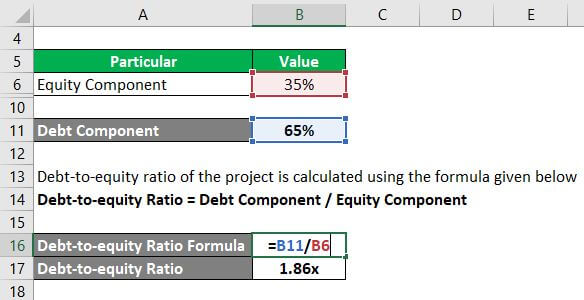

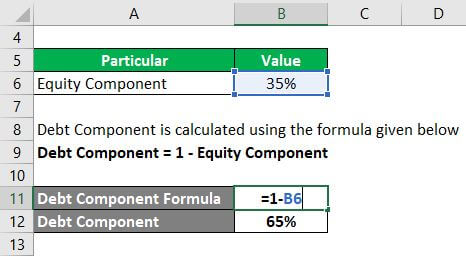

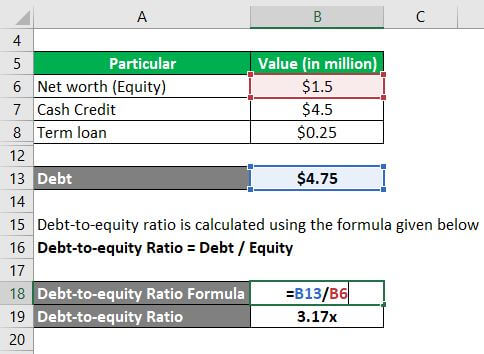

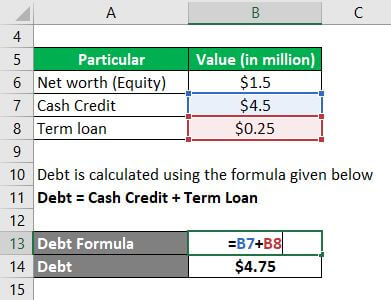

Capital Structure Complete Guide On Capital Structure With Examples

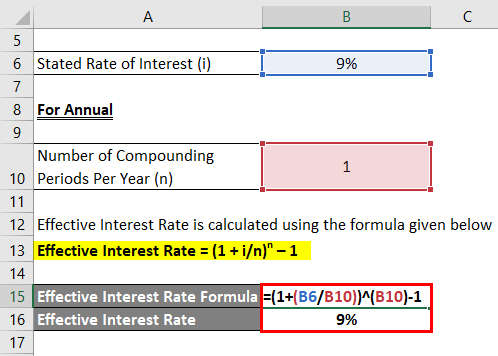

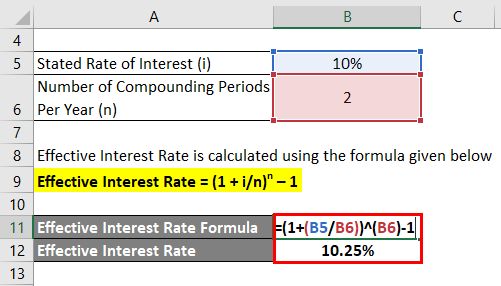

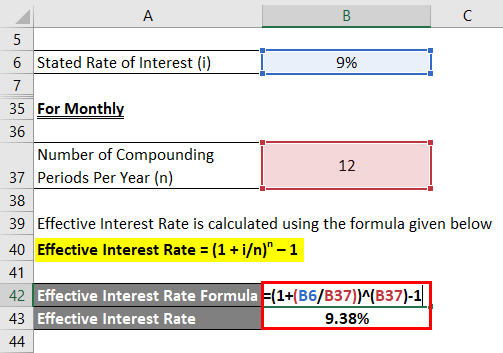

Effective Interest Rate Formula Calculator With Excel Template

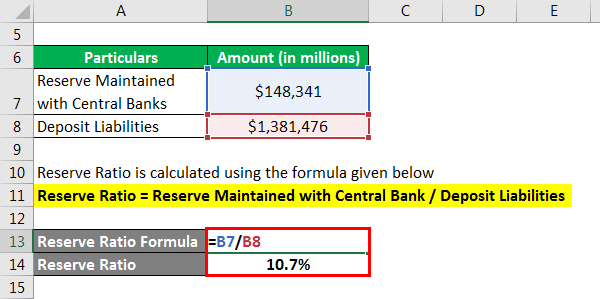

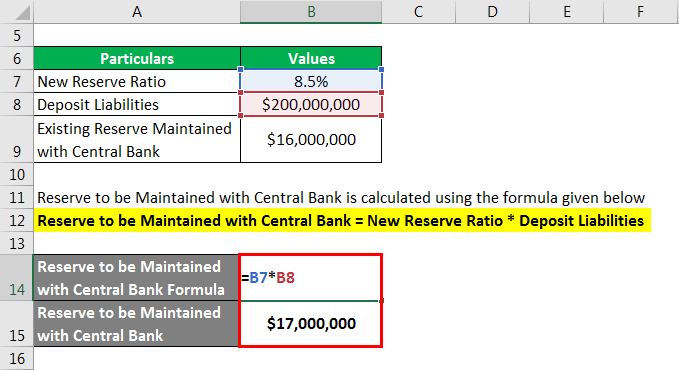

Reserve Ratio Formula Calculator Example With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

2

Capital Structure Complete Guide On Capital Structure With Examples

Short Term Loan Types And Examples Of Short Term Loan

Effective Interest Rate Formula Calculator With Excel Template

Capital Structure Complete Guide On Capital Structure With Examples

Capital Structure Complete Guide On Capital Structure With Examples

Current Liabilities Formula How To Calculate Current Liabilities

Capital Structure Complete Guide On Capital Structure With Examples

Capital Rationing A Complete Guide On Capital Rationing With Types

Debt To Income Ratio Formula Calculator Excel Template

Reserve Ratio Formula Calculator Example With Excel Template