2023 fica tax calculator

Do not use the. Know your estimated Federal Tax Refund or if you owe the IRS Taxes.

Tax Calculator Estimate Your Income Tax For 2022 Free

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for.

. For a single taxpayer or head of household who is 65 or. Increase the payroll tax rate to 161 up from the current 124 with no changes in the taxable income. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145.

As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022. The fica tax calculator exactly as you see it above is 100 free for you to use. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

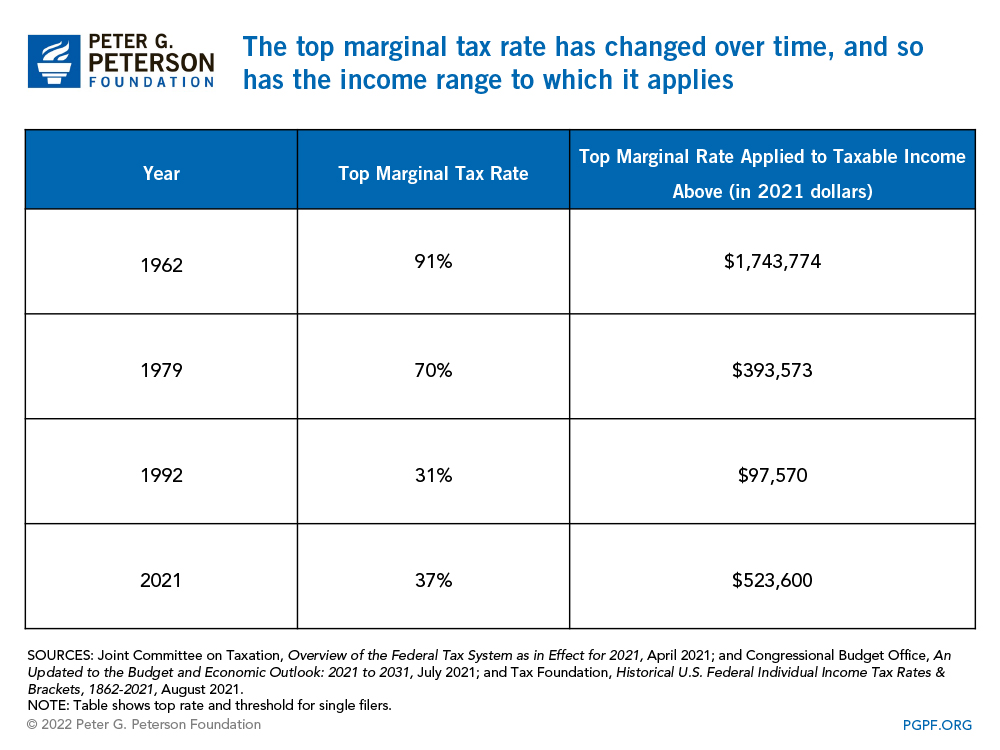

2023 Tax Calculator 01 March 2022 - 28 February 2023 Parameters. Start the TAXstimator Then select your IRS Tax Return Filing Status. CNBC reported that a recent congressional proposal.

ADP processing week number Sunday Thursday If you make a schedule change please check your Payroll Schedule to be sure you use the. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. You can calculate your FICA taxes by multiplying your gross wages by the current Social Security and Medicare tax rates.

Lets say your wages for. For example The taxable wages of Mr. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay. For 2023 the additional standard deduction for married taxpayers 65 or over or blind will be 1500 1400 in 2022. Calculate Your 2023 Tax Refund.

How to Calculate FICA Tax. For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. 2023 fica tax calculator Saturday September 17 2022 Also make sure this amount does not include any FICA self-employment or other taxes from Form 1040.

The aforesaid FICA tax calculator is based on the simple formula of multiplying the gross pay by the Social Security and Medicare tax rates. Under 65 Between 65 and 75 Over 75. Calculate Your 2023 Tax Refund.

Since the rates are the same for employers and. You have nonresident alien status. The FICA portion funds Social Security which provides.

Estimate your tax withholding with the new Form W-4P. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. You can calculate how much youll pay for FICA taxes by multiplying your salary by 765 taking into account any exceptions or limits that might apply to your situation.

Beginning in 2023 the taxable maximum. Estimate your 2022 Return first before you e-File by April 15 2023. Here are the provisions set to affect payroll taxes in 2023.

Daily Weekly Monthly Yearly. Use this calculator for Tax Year 2022. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

The OASDI tax rate for wages paid in. May not be combined with other. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare. 2021 Tax Calculator Exit. The SSA provides three forecasts for the wage base intermediate low and high cost and all predict an increase to 155100 in 2023.

Capital Gain Tax Calculator 2022 2021

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Tax Calculator Estimate Your Income Tax For 2022 Free

New York Tax Rate H R Block

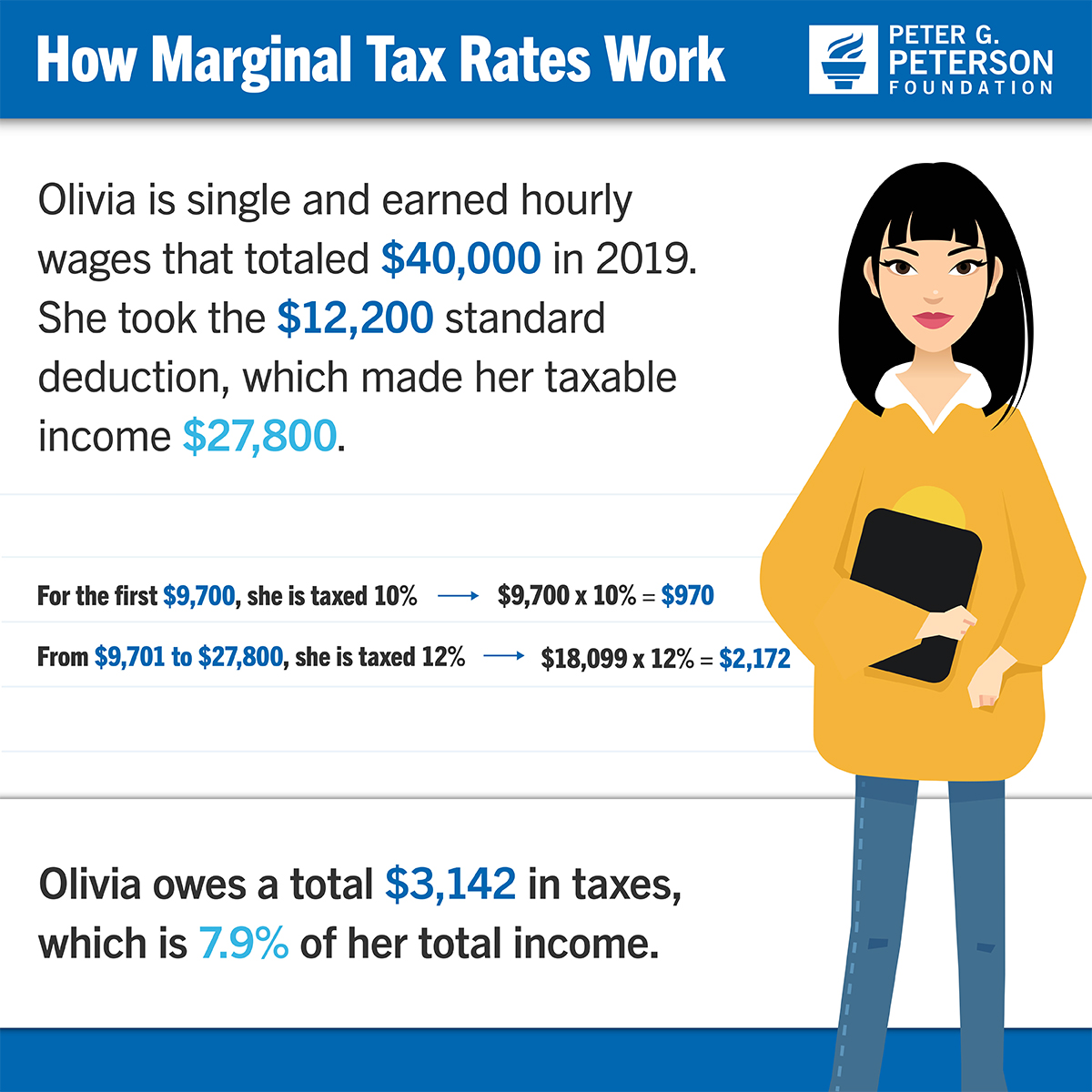

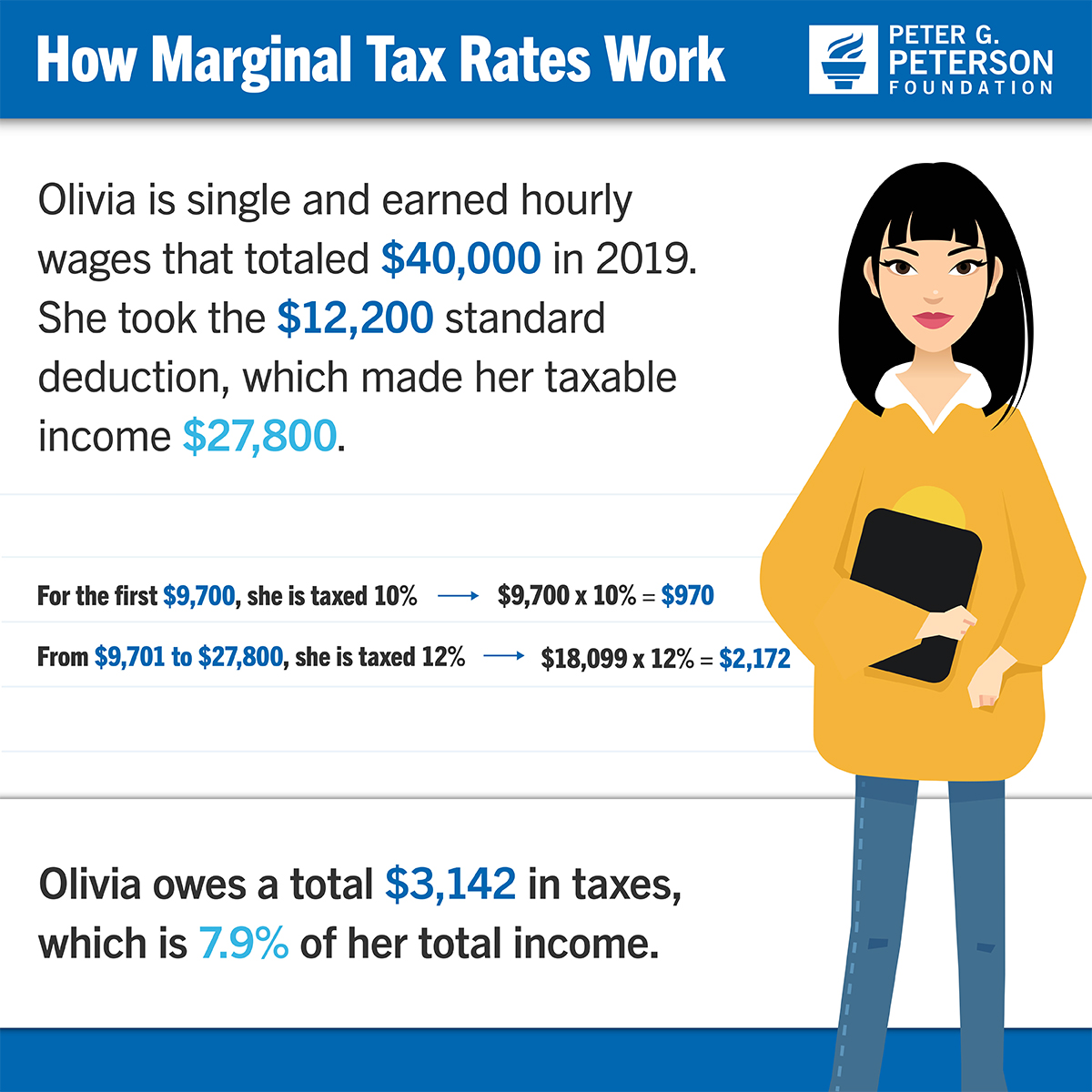

How Do Marginal Income Tax Rates Work And What If We Increased Them

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Us Tax Calculator 2022 Us Salary Calculator 2022 Icalcul

Llc Tax Calculator Definitive Small Business Tax Estimator

Corporate Tax Meaning Calculation Examples Planning

Tax Calculators And Forms Current And Previous Tax Years

Medicare Tax Rate 2022 Senior Healthcare Solutions

Easiest 2021 Fica Tax Calculator

2022 Federal State Payroll Tax Rates For Employers

Pin On Budget Templates Savings Trackers

Simple Tax Refund Calculator Or Determine If You Ll Owe

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

How Do Marginal Income Tax Rates Work And What If We Increased Them